When you’re looking to buy a home in Calgary, it’s essential to understand how property taxes work. Property taxes are a significant part of homeownership costs and can influence your decision-making process. This guide will help you navigate the basics of property taxes in Calgary, ensuring you’re well-informed before making a purchase.

What Are Property Taxes?

Property taxes are annual fees paid by property owners to fund local services and infrastructure. In Calgary, these taxes support various city services, including public safety, public transit, waste collection, parks, and more. Understanding how these taxes are calculated and what they fund can help you budget effectively and appreciate the value they bring to your community.

How Are They Calculated in Calgary?

Calgary’s property tax calculation involves three main components:

- Property Assessment:

- Each year, the City of Calgary assesses the market value of properties as of July 1 of the previous year. This assessment considers factors like location, size, age, and condition of the property. For example, the assessed value for a single family home in Midnapore may differ from a similar home in another quadrant of the city due to amenities, green spaces, and market demand.

- Municipal Budget:

- The city’s operating budget determines the amount of revenue needed from property taxes to fund services. This budget is approved annually by City Council.

- Provincial Requisition:

- A portion of your property tax goes to the Province of Alberta to fund education and other provincial programs.

The property tax rate is then applied to your property’s assessed value to determine your annual tax bill. For 2025, the residential property tax rate in Calgary is 0.0061803, combining both municipal and provincial portions.

Breakdown of Property Allocation

Understanding where your property tax dollars go can provide insight into the services you receive as a Calgary resident. Here’s a general breakdown:

- Provincial Education Taxes:

- Roughly 37% of your property tax supports education funding in Alberta.

- City Services:

- The remaining 63% funds essential services such as:

- Emergency Response: Police, fire, and EMS

- Road Maintenance & Public Transit

- Waste and Recycling Services

- Recreational Facilities and Libraries

- Maintenance of Green Spaces and Parks

These city services not only maintain the functionality of the city but also enhance quality of life, adding to the value of Calgary homes in both suburban and urban areas.

Breakdown of Property Allocation

Understanding where your property tax dollars go can provide insight into the services you receive as a Calgary resident. Here’s a general breakdown:

- Provincial Education Taxes:

- Roughly 37% of your property tax supports education funding in Alberta.

- City Services:

- The remaining 63% funds essential services such as:

- Emergency Response: Police, fire, and EMS

- Road Maintenance & Public Transit

- Waste and Recycling Services

- Recreational Facilities and Libraries

- Maintenance of Green Spaces and Parks

These city services not only maintain the functionality of the city but also enhance quality of life, adding to the value of Calgary homes in both suburban and urban areas.

Impact of Property Assessments

Your property’s assessed value directly affects your tax bill. If your home’s value increases more than the average in Calgary, you may experience a higher property tax bill, even if the rate stays the same. Conversely, if your home appreciates less than the citywide average, your taxes might decrease.

For 2025, the typical value change for residential properties in Calgary is 15%. Understanding how your home compares to this average can help you anticipate your tax bill. This is especially important for anyone considering midnapore real estate, where homes may be affected by unique factors such as proximity to Lake Midnapore, access to public transit, and demand for family homes.

Paying Your Taxes

The City of Calgary offers several payment options to make it easier for property owners to stay on top of their taxes:

- Annual Lump Sum:

- You can pay the full amount by the June 30 deadline.

- TIPP (Tax Instalment Payment Plan):

- This option allows homeowners to spread out payments over 12 months with automatic withdrawals. TIPP is especially helpful for those purchasing single family homes and managing new household expenses.

It’s essential to pay property taxes on time to avoid penalties and interest. Buyers should include their projected tax obligations in their financial planning.

Considerations When Buying a Home

When searching for a home—whether it’s a condo downtown or one of the many beautiful houses for sale in Midnapore—it’s important to factor property taxes into your decision. Here are a few tips for buyers:

- Include It in Your Buyer Checklist:

- Ensure you consider annual property taxes when budgeting for your mortgage, insurance, and utilities.

- Compare Neighborhoods:

- Property taxes may vary based on assessed value. Homes in newer communities or those with access to more city services might carry a higher assessment.

- Work with Real Estate Professionals:

- Experienced real estate agents can explain how taxes might affect your overall homeownership cost and guide you toward homes within your budget.

Whether you’re looking at a two-bedroom condo or a larger family home, understanding property taxes ensures you don’t face surprise costs after your purchase.

Resources from the City of Calgary

The City of Calgary offers several tools and services to help property owners understand and manage their tax responsibilities:

- Property Tax Calculator:

- This online tool estimates what your tax bill could look like based on your assessment.

- Assessment Search:

- Find and compare property values in your area, including similar midnapore homes for sale.

- Customer Review Period:

- If you believe your property has been assessed incorrectly, you can request a review during the designated window early each year.

These resources are especially useful for buyers new to the Calgary real estate market who want to make educated decisions.

Understanding Property Taxes is Crucial

Knowing how taxes are calculated, how to pay them, and what they fund can help you make a smart purchase. Whether you’re browsing midnapore real estate or exploring other Calgary neighbourhoods, factoring in property taxes helps you stay financially prepared and confident in your investment.

Before you finalize any purchase, talk to real estate professionals and use tools provided by the City of Calgary to stay informed. Your future self—and your wallet—will thank you.

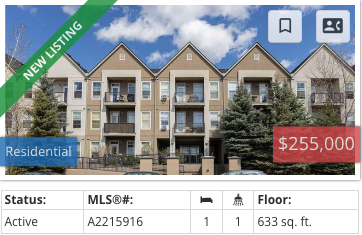

Houses for Sale Midnapore

Explore the latest listings in this scenic, family-friendly Calgary community.