If you’re thinking about purchasing a home in Calgary, you’re likely coming across a lot of unfamiliar real estate terms. Whether you’re working with a real estate agent, reviewing listings, or trying to make sense of mortgage options, knowing the language is crucial.

This Calgary guide covers 20 essential terms every homebuyer should understand. Whether you’re looking at condos downtown or midnapore houses for sale, this glossary will help you feel more confident and informed through the home buying process.

1. Appraisal

An appraisal is a professional estimate of a home’s market value. Mortgage lenders usually require it before finalizing a loan to make sure the purchase price aligns with the property’s actual worth. For example, if you’re buying a family home in Midnapore, the lender wants to confirm that the loan amount is justified based on current market values.

2. Closing Costs

These are the extra expenses you’ll pay at the end of a sale, on top of the purchase price. They include lawyer fees, land transfer tax, title insurance, and more. In Calgary, closing costs typically amount to 1.5–4% of the purchase price.

3. Down Payment

This is the portion of the home’s cost that you pay upfront. In Canada, a minimum down payment ranges from 5% to 20% depending on the purchase price. The larger your down payment, the less you’ll need to borrow and the lower your monthly mortgage payments.

4. Mortgage Pre-Approval

Getting a mortgage pre-approval means a lender has reviewed your finances and confirmed how much you can borrow. It strengthens your offer and helps focus your home search within budget.

5. Amortization Period

This refers to the total length of time you’ll take to pay off your mortgage. Most buyers in Canada choose 25 or 30 years. Shorter amortization means higher payments but less interest paid over the loan’s lifetime.

6. Gross Debt Service (GDS) Ratio

The GDS ratio helps determine if you can afford a home. It measures how much of your gross income goes toward housing expenses, including mortgage payments, property taxes, heating, and condo fees (if applicable). Lenders prefer it to be under 32%.

7. Total Debt Service (TDS) Ratio

This looks at your total debt load—including car loans, student debt, and credit cards—and compares it to your income. Lenders usually look for a TDS below 40–42%.

8. Title Insurance

Title insurance protects you and your lender from issues related to the property’s title, like fraud, unpaid taxes, or legal disputes. It’s a one-time cost paid at closing and is recommended for all buyers.

9. Home Inspection

Before finalizing a deal, most buyers arrange for a home inspection. This evaluates the condition of the home’s structure, roof, electrical systems, plumbing, and more. It’s especially important when buying older single family homes.

10. Conditional Offer

A conditional offer means the sale will only go through if certain conditions are met, like getting financing or passing a home inspection. If those conditions aren’t satisfied, the buyer can walk away.

11. Real Estate Agent

A licensed real estate agent helps buyers and sellers navigate the housing market. They assist with finding properties, negotiating offers, and managing paperwork. Many buyers rely on real estate professionals to guide them through each step.

12. Purchase Agreement

This is the legal contract between buyer and seller that outlines all terms of the home sale, including the purchase price, conditions, and closing date.

13. Closing Date

This is the date when the legal transfer of the property takes place. You’ll pay the remaining balance, and the keys to your new home are handed over.

14. Property Taxes

In Calgary, property taxes are based on your home’s assessed value and fund essential city services like snow removal, libraries, public transit, and green spaces. Property taxes are paid annually and should be included in your monthly budgeting.

15. Single Family Homes

These are stand-alone homes built for one household. They often have private yards and no shared walls, making them popular among families looking for space and privacy.

16. Condominium (Condo)

Condos are individually owned units in a building or complex. You share common areas with other residents and pay monthly condo fees for maintenance and amenities.

17. Homeowners Association (HOA)

In some Calgary communities, including newer developments, HOAs manage shared community resources like parks, paths, and recreational buildings. They may charge annual fees and have community rules.

18. Equity

Equity is the difference between your home’s market value and what you still owe on the mortgage. As you pay down your loan or if your home’s value rises, your equity increases.

19. Fixed-Rate Mortgage

With a fixed-rate mortgage, your interest rate stays the same for the length of time in the term (e.g., 5 years), making monthly budgeting easier.

20. Variable-Rate Mortgage

This type of mortgage has a rate that can change with the market. You might pay less when rates drop, but there’s more risk if rates rise.

Frequently Asked Questions (FAQ)

What’s the difference between pre-qualification and pre-approval?

Pre-qualification is a quick estimate of how much you might borrow, while pre-approval is a formal commitment from a lender after reviewing your credit and finances. Always aim for pre-approval when seriously purchasing a home.

Can I include my closing costs in my mortgage?

In most cases, no. Closing costs must be paid out-of-pocket. Lenders want to see that you can cover these expenses yourself. Be sure to include them in your financial plan for purchasing a home.

How do property taxes work in Calgary?

Property taxes are calculated based on the assessed value of your home. The City of Calgary posts rates each year. These taxes support city services such as waste management, emergency response, and public transportation. You can pay property taxes annually or join a monthly payment plan.

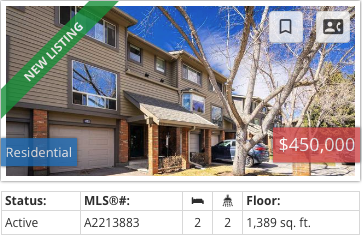

Are midnapore houses for sale good for first-time buyers?

Yes. Midnapore is a well-established neighbourhood with a mix of townhouses, condos, and single family homes. It offers access to green spaces, Lake Midnapore, and public transit options—ideal for both growing families and professionals.

How long does the home buying process take?

The length of time can vary. On average, it takes 30 to 60 days from making an offer to closing the sale. If you’re working with experienced real estate professionals and have a mortgage pre-approval, the process can go more smoothly.

Understanding Terms is Key

Understanding these real estate terms can take a lot of the confusion out of buying a home. Whether you’re looking at downtown condos or midnapore houses for sale, this glossary is your Calgary guide to making smarter decisions.

Real estate professionals are there to support you, but having a strong foundation in the basics will make you a more confident buyer. Purchasing a home is a big step, but with the right knowledge and team, it’s one you can take comfortably.

Houses for Sale Midnapore

Discover available properties in one of Calgary’s most desirable neighbourhoods.