If you’re buying a home in Calgary, Alberta, you’ve likely heard about title insurance—but what is it, and do you really need it? Title insurance is a key part of buying a home. It protects homeowners and mortgage lenders from unexpected problems with the property title. Whether you’re exploring houses for sale in Calgary or preparing to close a deal, understanding how this type of protection works can save you time, money, and stress.

What Is Title Insurance?

This policy offers legal title security that protects property owners and lenders from financial losses due to title-related problems. The “title” is your legal right to own and use the property. Ideally, the land title should be clear—meaning no one else can legally claim it. But sometimes issues like unpaid taxes, builders liens, or mistakes in public records can surface, even after the deal is closed.

There are two primary types of coverage:

Lender’s Policy: Secures the mortgage lender’s interest in the property.

Owner’s Policy: Covers you, the homeowner, from specific title-related risks.

Both are commonly used in real estate transactions across Calgary and the rest of Alberta.

Why Ownership Protection Matters

When you buy a home, you expect a clean title and no surprises. Unfortunately, issues can arise—sometimes long after you’ve moved in. Property title coverage helps protect against those hidden problems that aren’t discovered during a standard land title search.

Here are a few common risks that ownership protection can help you avoid:

Title Defects: Mistakes in property records or unresolved legal issues that affect ownership.

Builders Liens: Claims filed by contractors who were not paid by the previous owner.

Fraud or Forgery: Unauthorized individuals impersonating a property owner or falsifying documents.

Unpaid Property Tax: Tax arrears that become your responsibility after closing.

Unknown Interests: Previously undisclosed legal claims on the property.

For buyers of Calgary homes, especially in competitive markets, these problems can be both expensive and stressful. A good coverage plan provides peace of mind that your investment is secure.

What Does Property Title Coverage Include?

Standard owner’s protection often includes:

Legal fees if you need to defend your title

Financial compensation for covered losses

Protection equal to the home’s purchase price

However, this coverage doesn’t replace home insurance. It won’t pay for fire damage, flood repairs, or issues you caused yourself—like zoning violations. Always speak with your lawyer or insurance provider to review the exact policy terms.

How to Purchase Title Coverage

Most buyers arrange their title protection at the time of closing. Your lawyer typically handles this process, working with a licensed insurance company. It’s a one-time fee, and there are no ongoing payments or annual premiums.

If you didn’t get covered when you first bought your home, you may still be eligible. Speak with your real estate professional or lawyer about adding a policy post-purchase.

What Makes Alberta Unique?

Alberta’s land title system is thorough, but even with detailed public records, errors can occur. That’s why title risk protection is recommended, even when buying in a well-regulated city like Calgary.

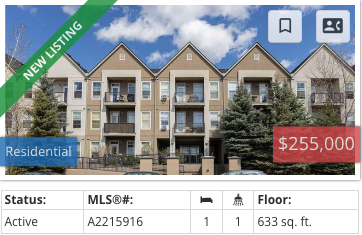

For example, the Calgary real estate market includes everything from historic homes to newly built condos. Older homes may come with incomplete title histories, while new builds can face issues like unregistered liens. In both cases, having protection helps avoid future legal battles over property ownership.

Who Needs This Kind of Protection?

Ownership security is a wise choice for many types of buyers:

First-time homebuyers

Investors and landlords

Buyers of resale or new homes

Condo and strata unit purchasers

Mortgage lenders (often mandatory)

Whether you’re closing on a detached home in Midnapore or exploring a downtown condo, having a clear and defensible title is essential. This is especially true in areas where average home prices are rising, and competition is high.

Role of Mortgage Lenders

Mortgage lenders in Alberta nearly always require a lender’s policy as a loan condition. This safeguards their investment if legal title issues arise. While this doesn’t protect you directly, it’s usually bundled with a homeowner’s policy so you benefit as well.

How Much Does It Cost?

The price of property title coverage is typically affordable and based on the property’s value. For most Calgary real estate transactions, the cost is a one-time fee paid at closing. Compared to long-term risks like fraud, unpaid taxes, or undiscovered liens, it’s a small investment for significant peace of mind

South Calgary Title Insurance

Property ownership comes with many responsibilities—and potential risks. Whether you’re browsing houses for sale in midnapore or signing your final papers, ensuring your title is protected is essential.

Title protection isn’t just another line item in your legal fees. It’s a tool that helps secure your investment, especially in a fast-moving market like Calgary. It offers protection from hidden issues like title defects, unpaid taxes, and builder disputes that might otherwise cause serious financial damage.

If you’re buying a home in Calgary, Alberta, make sure to speak with your lawyer or mortgage broker about this often-overlooked but highly valuable policy. The right choice today could save you from legal headaches tomorrow.

Houses for Sale Midnapore

Explore the latest listings in this scenic, family-friendly Calgary community.